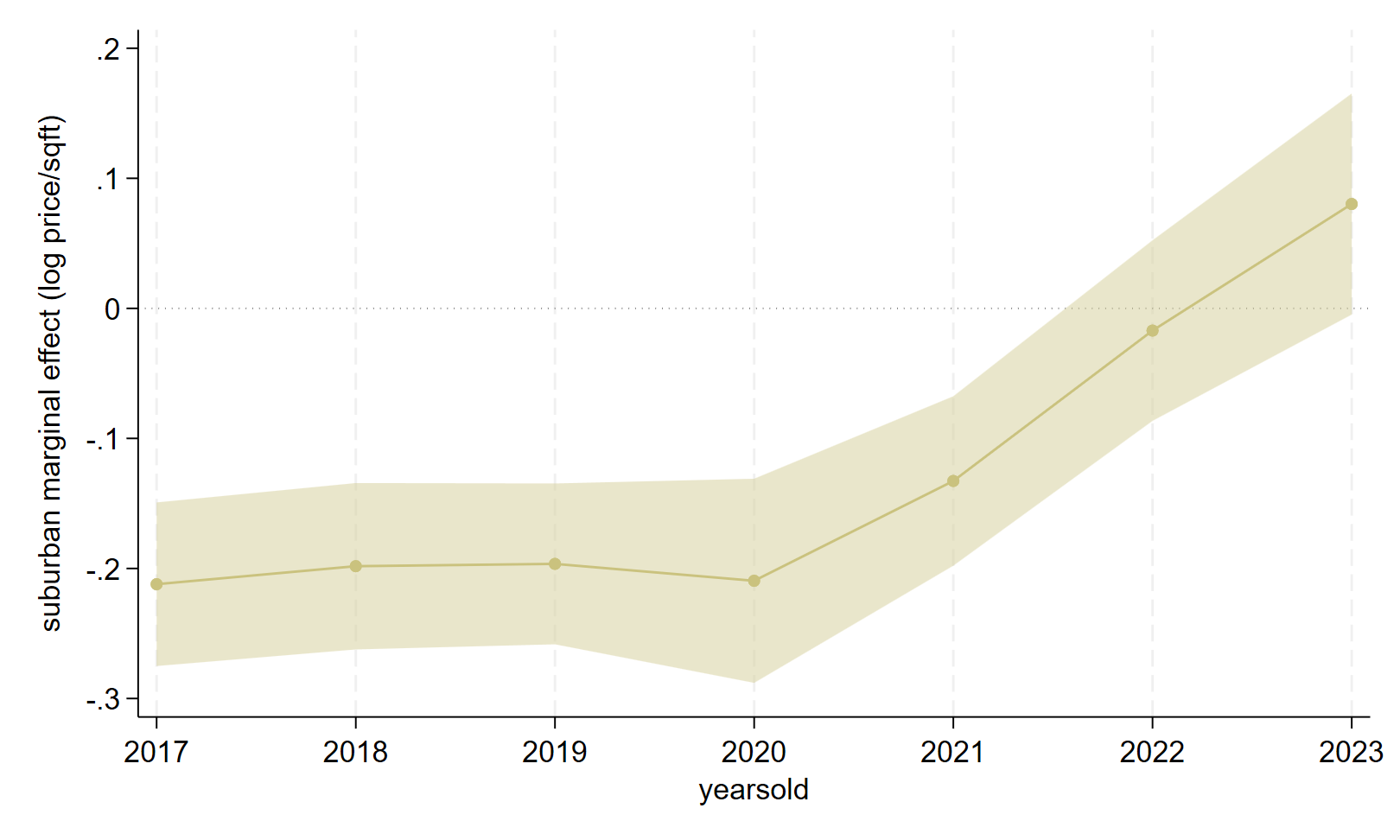

We examine how the shift to working from home (WFH) differentially affected urban and suburban commercial real estate (CRE) prices in U.S. cities. Using CRE transaction data from 2017 to 2023, we document significant suburban price appreciation relative to urban prices beginning in 2021. This relative appreciation results in the overall CRE suburban price discount shrinking from 9% to zero by 2023. Heterogeneity analysis reveals that relative suburban price appreciation is concentrated in cities with a high proportion of jobs amenable to WFH. Office real estate displays the most significant shift in the suburban price discount—previously stable at 20%, the discount shrinks to zero by 2021 and trends toward a suburban price premium by 2023. These findings support the hypothesis that the transition to WFH reorganized the demand for commercial real estate assets with respect to urban and suburban locations within cities and that this effect is likely not temporary.

Published at the Journal of Real Estate Research here.